Gratuity Calculator UAE

Calculate your End of Service benefits using this Free Online Gratuity Calculator UAE, created in accordance with the new Labour Law and supervised by the Ministry of Human Resources and Emiratisation (MOHRE). This easy-to-use tool follows the latest MOHRE-approved formulas and complies with Article 51 of the UAE Labour Law to ensure your entitlement is accurate and transparent.

What is Gratuity (مكافأة) in the UAE?

Gratuity, officially known as the End-of-Service Benefit (EOSB), is a mandatory lump-sum payment every employer in the United Arab Emirates (UAE) must provide to eligible employees upon leaving the company. Whether you work in Dubai, Abu Dhabi, Sharjah, or a free zone such as JAFZA, gratuity represents the employer’s appreciation and serves as a financial safety net after you complete your service.

Under the UAE Labour Law, expatriate employees in the private sector are entitled to gratuity after one year of continuous employment, while Emirati employees can opt into the new voluntary End-of-Service Scheme introduced by MoHRE.

Why Use an Online Gratuity Calculator UAE?

Manually calculating gratuity can be complicated, especially when considering contract type, service duration, basic salary, and Article 120 or Article 132 provisions. The Gratuity Calculator UAE 2025 automates the process for both limited and unlimited contracts, reflecting changes made after the 2023 labour-law reform that standardised all contracts into fixed-term (limited) agreements.

The Online Gratuity Calculator automates the process, giving you an accurate estimate of your end-of-service benefit in seconds.

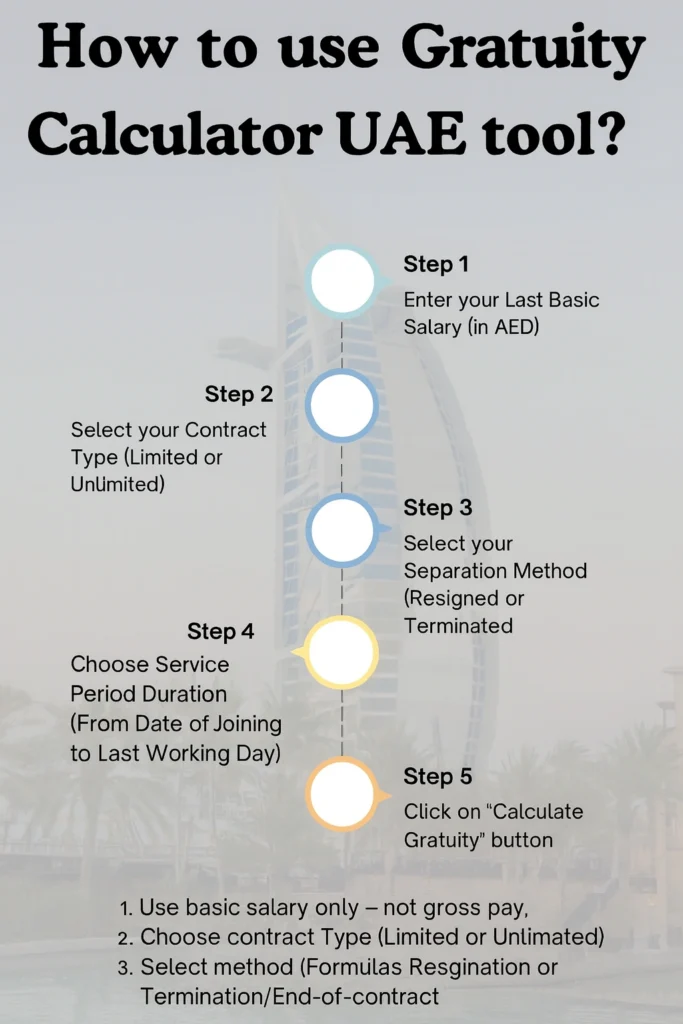

To use it, you only need to provide:

- Your basic salary (the fixed amount stated in your contract, excluding allowances).

- Contract type – limited or unlimited.

- Reason for leaving – resignation or termination.

- Start and end dates of employment.

Once you enter these details, the gratuity calculator instantly applies the official formula approved under UAE labour rules to show your entitlement.

Who Is Eligible for Gratuity in the UAE?

To qualify for gratuity payment under Article 51 of the UAE Labour Law, you must meet certain conditions:

- You must have completed at least one year of continuous service.

- You must leave lawfully, either by resignation or termination with proper notice.

- You must not be dismissed for misconduct under Article 120 (theft, fraud, or serious policy violations).

- The rule applies to expatriate employees; UAE nationals participating in the voluntary scheme are governed by MoHRE subscription terms.

Your employer must pay your gratuity within 14 days of your final working day as per Article 53 of the UAE Labour Law.

Minimum Service Period and Basic Salary Rules

Your gratuity is calculated solely on your basic salary, not on your total income. Allowances for housing, transport, or utilities are excluded.

Example: If your total monthly pay is AED 10,000 but your basic salary is AED 7,000, all gratuity calculations will be based on AED 7,000.

You must also have completed a minimum of one year of service. Employees who resign or are terminated before completing 12 months are not entitled to any gratuity payment.

Limited and Unlimited Contracts Explained

Before 2023, the UAE Labour Law recognised two main types of contracts: limited (fixed-term) and unlimited (open-ended). The new law now standardises employment agreements into fixed-term contracts; however, many employees still work under older unlimited contracts.

Understanding Limited vs Unlimited Contracts is essential because each affects the gratuity formula differently.

How Gratuity Is Calculated in Limited Contracts

A limited contract specifies a clear start and end date. Employees under this contract who complete one year or more of service are entitled to gratuity as follows:

| Years of Service | Gratuity Calculation Formula |

|---|---|

| 1 to 5 years | (Basic Salary × 21 days × Years of Service) ÷ 30 |

| More than 5 years | (Basic Salary × 30 days × Years of Service) ÷ 30 |

If an employee resigns before the contract expires or fails to serve the agreed notice period, the employer may proportionally reduce the payment according to the terms of the agreement.

How Gratuity Is Calculated in Unlimited Contracts

Unlimited contracts had no fixed end date. Under older rules, gratuity entitlement differed depending on whether the employee resigned or was terminated.

When the Employee Resigns

- Less than 1 year: No gratuity.

- 1 to 3 years: One-third of 21 days’ basic pay per year.

- 3 to 5 years: Two-thirds of 21 days’ basic pay per year.

- More than 5 years: Full 21 days’ salary for each of the first 5 years and 30 days’ salary for every additional year.

When the Employee Is Terminated

- Less than 1 year: No gratuity.

- 1 to 5 years: 21 days’ basic pay per year.

- More than 5 years: 21 days for the first 5 years and 30 days for each subsequent year.

These rules ensured fair compensation but prevented employees from claiming end of service if they left too early without valid reason.

Example of Gratuity Calculation

Basic Salary: AED 8,000

Service Duration: 6 years

Contract Type: Limited

- Daily Wage = 8,000 ÷ 30 = AED 266.67

- First 5 Years = 266.67 × 21 × 5 = AED 27,999

- Additional 1 Year = 266.67 × 30 × 1 = AED 8,000

✅ Total Gratuity = AED 35,999

Maximum Limit on Gratuity Payments

Regardless of how long an employee serves, the total gratuity cannot exceed two years of basic salary.

Example: If your basic pay is AED 5,000, the highest gratuity you can receive is AED 120,000 (5,000 × 24 months).

This ceiling ensures fairness between employees and employers.

Contract Renewals and Continuous Service (Article 38)

If your fixed-term contract is renewed, the new term is considered an extension of your existing employment. This means the total period across both contracts counts as continuous service for gratuity purposes.

For example, if your first contract lasted two years and you renewed for another three, your gratuity will be calculated based on five years of total service, not separately.

Can Gratuity Be Denied?

Yes, gratuity may be withheld in limited circumstances. An employer can refuse payment if an employee:

- Resigns without serving the notice period or without legitimate reason (Article 121).

- Leaves the job before completing one year of service.

- Is dismissed for misconduct such as theft, fraud, or violation of workplace policies (Article 120).

If you feel unfairly treated, you can file a complaint with MOHRE or MOL UAE, which can investigate and impose penalties under Article 53.

What Happens If Employers Don’t Pay Gratuity?

Failing to pay gratuity within 14 days after employment ends can lead to legal penalties. Employers risk:

- Heavy administrative fines.

- Suspension of trade licences.

- Restrictions on hiring new employees.

- Legal intervention by MOHRE or labour courts.

Employees can File Complaint for Delay in Gratuity Payment through the MOHRE app, helpline, or by visiting the nearest labour office.

The UAE Labour Law empowers MOHRE to enforce settlements, protecting employee rights across Dubai, Sharjah, and Abu Dhabi.

Final Settlement and Other Dues

When you leave a job, your Full and Final Settlement (FFS) includes:

- Unpaid salary.

- Payment for unused annual leave.

- Gratuity entitlement.

- Any bonuses or commissions due.

- Deductions for loans or advances.

Formula:

Final Settlement = (Unpaid Salary + Leave Encashment + Gratuity + Allowances) – Deductions

All these payments must be cleared within two weeks of your last working day.

Gratuity for Domestic Workers in the UAE

Domestic workers, such as housemaids and drivers, are covered under separate legislation. They are entitled to one month’s basic salary for each completed year of service. The gratuity must be paid within ten days of termination.

However:

- Unused leave days are not added to the gratuity.

- Employers may deduct sums for damage or unpaid advances under Article 135.

- Payment must be made within ten days of termination.

This ensures fair treatment of household staff in line with UAE labour protection standards.

Gratuity vs Tip – Understanding the Difference

Although both sound similar, gratuity and tips are entirely different concepts.

| Aspect | Gratuity | Tip |

|---|---|---|

| Definition | Legal end-of-service payment from employer | Voluntary payment from customer |

| Obligation | Mandatory under UAE law | Optional |

| Payer | Employer | Customer |

| Purpose | Reward for long-term service | Appreciation for good service |

| Calculation | Based on salary × service years | Depends on customer discretion |

Tips to Maximise Your Gratuity in the UAE

- Understand the Labour Law

Keep yourself updated with MOHRE announcements so you know your rights and eligibility. - Read Your Employment Contract Carefully

Ensure clarity on your basic salary, job duration, and renewal terms. - Keep Detailed Records

Maintain copies of contracts, pay slips, and correspondence to verify service history. - Serve Your Notice Period

Completing the notice period (usually 30 to 90 days) protects your right to gratuity. - Use a Gratuity Calculator Tool

Regularly check your expected entitlement so you know what to expect when leaving. - Get Employer Clearance

Before your last day, confirm that all loans and advances are cleared to avoid deductions. - Communicate Professionally

Discuss any discrepancies politely with HR before escalating to MOHRE. - Follow Up After Leaving

Keep written records of your requests for gratuity payment. - Seek Legal Guidance if Needed

Labour-law consultants can assist if your employer refuses payment.

Common Mistakes to Avoid

- Using gross salary instead of basic salary.

- Entering wrong service dates (affecting Article 38 calculations).

- Confusing resignation and termination provisions (Articles 132 & 137).

- Ignoring deductions under Article 135.

- Referring to outdated laws before the 2023 reforms.

Avoiding these mistakes ensures the Gratuity Calculator produces an accurate estimate every time.

Comparison of Resignation vs Termination Entitlements

| Service Duration | On Resignation | On Termination |

|---|---|---|

| < 1 year | No gratuity | No gratuity |

| 1–3 years | ⅓ of 21 days’ pay per year | Full 21 days per year |

| 3–5 years | ⅔ of 21 days’ pay per year | Full 21 days per year |

| > 5 years | 21 days for first 5 years + 30 days after | Same rate |

This table shows how resignation can reduce benefits compared to termination under older contracts.

Frequently Asked Questions (FAQs)

Q1. How do I calculate my gratuity?

Use the Online Gratuity Calculator UAE, enter your basic salary in AED, contract type, and service duration to get an instant estimate.

Q2. Is gratuity taxable?

No, the UAE imposes no income tax.

Q3. Can gratuity be paid in advance?

No, it’s due only after your employment officially ends.

Q4. Can I resign after one year?

Yes, once you complete a year under a limited contract, you’re entitled to gratuity.

Conclusion

Gratuity in the UAE is more than an end of service payment because it represents your dedication and contribution to your employer. According to the UAE Labour Law and the regulations set by MOHRE, every employee who completes at least one year of continuous service has the right to receive a fair and timely settlement based on their basic salary.

By understanding your contract type, keeping accurate records and staying aware of Articles 51, 132 and 135, you can make sure your end of service benefits are calculated correctly. Whether you are working in Dubai, Abu Dhabi or Sharjah, knowing your rights under UAE law will help you secure your financial future with confidence.